Payment Processing Resources

Advice, Insight, Recomendations, Case Studies, Reviews, Help and Much More!

Discover the top 10 eCommerce shopping cart software solutions that can revolutionize your online store. This comprehensive guide provides insights into each platform's features, customization options, pricing, and more. Find the perfect shopping cart software to streamline your operations, enhance the customer experience, and drive the success of your online business.

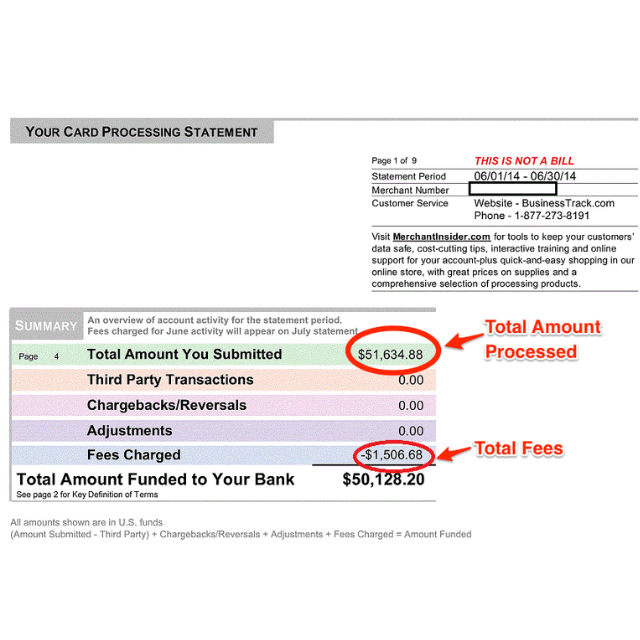

Have you ever wondered exactly how credit card processing works and what makes up credit card processing fees? Do you think you are paying too much for your credit card processing fees? Well...we will tell you the best way to determine if you are paying too much or at least take a second look at your credit card processing fees. The majority of your credit card processing fees are assessed by what we call interchange + assessment fees, which will make up a more generous portion of your credit card processing fees. Interchange + Assessment Fees are the SAME for every MERCHANT. However, the markup or the additional credit card processing fees beyond these rates are the actual markup on your merchant account. There is not a one size fits all credit card processing model out there. Still, businesses have better advantages to use a specific pricing model, given the number of transactions, volume processed, card present, card not present, etc. The best way to determine your total credit card processing fees is to take your total fees divided by the amount you processed, which will give you a net effective credit card rate. Thus, if your rate is higher than you expected, you might want to take a second look at your statement or get a free statement analysis from a reputable credit card processing company. But first, let us look at what makes up those credit card processing fees. The majority of credit card processing fees look like the example below: Interchange + Assessments (Wholesale Rates) + Markup (Discount Rate or Tiered or Flat Rate + Transaction Fee) + Monthly Fee What are interchange + assessment fees? The interchange + assessment fees are just wholesale credit card processing fees that are virtually wholesale cost for every processing company, merchant, etc. These wholesale fees are unavoidable. How much are interchange + assessment fees (wholesale) rates? The wholesale credit card processing fees are primarily dependent on the card type and how the transaction is entered. To keep it simple, the best rule of thumb on pricing is to break down whether the card is present versus not present. However, there can still be variability in the types of cards taken in, average sale or ticket amount, demographic, business type, etc. Any merchant should obtain a statement analysis to breakdown all data to ensure a more accurate assessment. Types of Credit Card Environments Credit Card Present Swiped, Dipped, Contactless Credit Card Not Present Keyed, E-Commerce, MOTO (Mail Order Telephone Order), Recurring Transaction Typical Wholesale Rates Cost of Card Present (Average Interchange + Assessment Fees) Usually Ranges from 1.2% to 2.2% Cost of Card Not Present (Average Interchange + Assessment Fees) Usually Ranges from 1.6% to 2.8% So what is marked up for credit card processing fees? Typically, on your merchant account, whatever is over the actual wholesale rates (Interchange + Assessment Fees) is the mark upon your processing account. However, every merchant is different in terms of the average sale amount, the number of transactions, etc. The most common pricing is tiered pricing and interchange (wholesale) plus pricing. Flat rate pricing is pretty standard but is sometimes advantageous to specific merchants given ticket amount and number of transactions. Pricing for Credit Card Processing Fees (Markup) Interchange (Wholesale) Plus Pricing Interchange plus pricing will include a fixed markup on the account and will usually have an item on your statement as a discount percentage. This pricing passes the cards' wholesale rates to you as the merchant with only a fixed markup—usually, the most preferred pricing in terms of credit card processing fees. Tiered Pricing Tiered pricing is a complex pricing structure that usually ends up costing the merchant more in processing fees. Tiered pricing usually has 2 to 3 tiers (Qual, Mid-Qual Non-Qual. The tiered pricing is usually well over the cards' wholesale rate, as certain cards are placed in these tiers or buckets. Essentially processors will have a fixed markup above and beyond the actual wholesale rates of the cards. Flat Rate Pricing Flat rate pricing is similar to that of tiered pricing, except that everything will run at the actual flat rate price for all cards. Sometimes this is beneficial for merchants that have low volume or smaller transaction sizes. So, what is the best way to determine my total credit card processing fees? Net Effective Rate, of course! The net effective rate is the total credit card processing fees divided by total sales volume for any given month on your credit card processing statement. The net effective rate is usually expressed in the form of a percentage, and it's is one of the quickest ways to uncover if you're paying too much for your merchant account. Total Fees/Volume of Sales = Net Effective Rate How do I figure out if I am paying too much for my credit card processing fees or my rate is too high? Understanding general credit card processing fees is something all business owners should eventually explore. Just having a credit card processing company or agent look at your credit card processing statement, you may be able to save hundreds if not thousands a month in fees. Statement analysis and an audit of your POS are the best way for a business to determine exact numbers. Below are industry averages in credit card processing fees and if you should take a second look at your costs. Suppose your net effective rate is way higher than the percentages below. Typical/Fair Pricing on Net Effective Rate Average Card Present (Swipe, Dip, Contactless) 1.8% - 2.2% Average Card Not Present (Online or E-Commerce, Recurring, MOTO, Keyed) 2.5% - 3.2% Every merchant is different in every aspect of their business, and there is no one size fits all credit card, processing model. Speaking with a knowledgeable credit card processing agent or company will help streamline your processing and help lower your cost of credit card processing fees. Contact us today for a free statement analysis and review of your credit card processing fees.

Sign up and stay up-to-date about what's happening at our site.